Most of these bills cap insulin at $100. Is that for everyone?

In brief, no. Most bills proposed so far, including the one in Colorado, only cap the copay for individuals with health insurance. Another important factor is that this law is not applicable under all forms of insurance. So, not everyone with insurance may qualify. Plans that are subject to federal regulation may be ineligible for this price cap, such as self-funded employer plans that are regulated under federal ERISA rules and the health insurance plans offered to the armed services (TRICARE), and Medicare. Individuals also cannot visit other states to qualify for capped insulin costs - if you're from Nebraska, for instance, and go to a Coloradan pharmacy, you will not be able to qualify for $100 insulin.

So...Who pays for this?

Contrary to what some have stated, no, taxpayers are not funding this cap. Unfortunately, neither are pharmaceutical companies. Insurance companies will have the cost pushed onto them. Does this mean premiums could rise for individuals? Possibly. However, it's very important to note that insurance companies do not pay full list price for insulin, either. Let's explore more on that below.

How much DO insurance companies spend on insulin when providing it to patients covered under their plans?

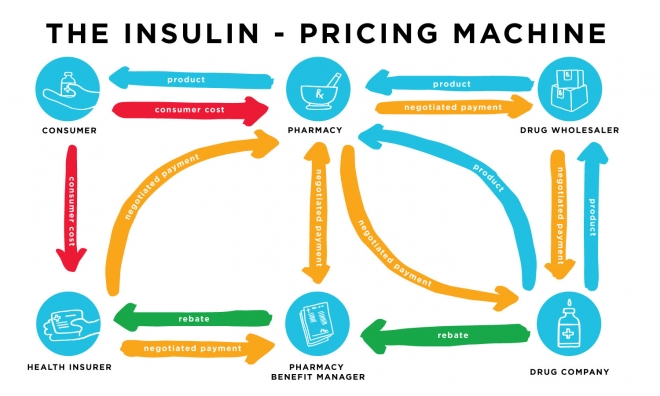

Ooh boy... this is a complicated question. Insulin arrives at the pharmacy either directly from the pharmaceutical company, or through a prescription drug wholesaler who has obtained the drugs from the pharmaceutical company. There are negotiated payments from the wholesaler to the drug company, from the pharmacy to the wholesaler or drug company, from the insurance company to the pharmacy, from the insurance company to the PBM*, and between the pharmacy and the PBM*. Then there are the rebates the drug companies give to the PBM, and the PBM gives a portion of that rebate to the insurance company. This all changes the cost from the time the insulin leaves the manufacturer until it reaches the customer at a retail pharmacy. It means prices can vary wildly for individuals purchasing insulin, but it also means that insulin companies pay far less than list price for a vial of insulin.

What are PBM's?

* PBM = pharmacy benefits managers. Let's talk more about those, shall we? This is where the insulin pricing system gets very complicated, because there are five entities making money from the singular transaction of a customer purchasing their insulin at the pharmacy. PBM's are third party intermediaries who negotiate prices between drug companies and insurance companies. Well, they're supposed to be third party - but this line is getting very blurred. The three largest PBMs are Express Scripts, CVS Caremark and OptumRX. OptumRx is owned by United Healthcare, Cigna recently merged with Express Scripts, and CVS Health acquired Aetna. Kind of crazy, right? PBMs’ stated goal is to reduce costs from pharmaceuticals for the insurance companies while improving health outcomes for the members of the insurance plans. Insurance companies receive rebates from the pharmaceutical companies via the pharmacy benefit managers. PBM's in exchange, take a share of the profits from prescriptions that are sold to members of the insurance plans. PBM's are thus often invisible to consumers and can drive up the costs of prescriptions without consumer awareness. So, to recap, drug companies and wholesalers provide insulin to the pharmacy, and then PBM's help negotiate the sale of insulin from the pharmacy to insurance companies, who then provide it to consumers).

To obtain a preferred spot on a PBM’s formulary, drug companies are often forced to bid against their competition by offering greater and greater rebates. Drug manufacturers are then being forced to maintain or increase pricing as a hedge against discounts and rebates taken by the middlemen (PBM's) to keep the manufacturer’s products competitive for coverage by health insurers and sale through consumer prescription drug plans. Thus, the individual without insurance, or with a high deductible plan, pays a higher list price on insulin, while the insurance company does not necessarily.

I had to take a break after writing that... it's a LOT of info.

So who do these bills benefit?

Well, they do a lot of good, absolutely. When I was a student and the only plan my school offered was high deductible, it would have helped a lot to have prices capped at $100, because since my deductible was $4500+, I would have to pay that before my insurance helped to pay. AND... medications such as insulin do not always count towards your deductible! So even spending a crazy amount on the cash price may not do much good. So, they really help individuals with those kind of plans.

Is the total amount you spend on insulin capped at $100?

Sadly no - it's $100 or less per insulin you fill. Most diabetics still need 2 types on insulin a month. Lawmakers in Colorado are actually seeking to close that loophole and clarify the cap language, however, so this could change.

So if you don't have insurance, you don't qualify for the $100 cap?

Yep, unfortunately that's correct. However, some bills proposed, such as one in Tennessee, would cap prices at $30 for those with health insurance and without. This would be very beneficial!

What else needs to be done?

Many lawmakers who have proposed these bills so far acknowledge that it's a temporary fix. These bills are doing incredible good and helping to ease the pricing burden on consumers, and it was a fast way to help alleviate some of the crisis that many of us who can't afford insulin face. The fact still stands that the majority of people who ration their insulin (26% of diabetics, it's estimated) are not insured, but steps are actively being taken to try to address this on a level that more places responsibility on drug companies. It's a complicated issue with the PBM's for sure... although considering the major insurance companies own the major 3 PBM's, maybe it's a lot more simple that we realize. At any rate, there's still work to be done - so don't take these bills as a sign that we can stop advocating for affordable insulin pricing any time soon.

No comments:

Post a Comment